-

2024 Annual Open Enrollment

for ATU, DCU, PAT, & PFSP Employee Groups ONLY

(H&W Trust Open Enrollment is NOT for Non-Represented & SEIU Employee Groups)

Monday, October 9, 2023 - Friday, October 27, 2023

-

IMPORTANT:

- H&W Trust Open Enrollment is your opportunity to:

-

- Review/Change your health insurance package options;

- Update (add/remove) dependent(s); and

- Enroll in the FSA (Health Care and/or Dependent Care) for 2024.

- Review/Change your health insurance package options;

- Your benefits selections made during H&W Trust Open Enrollment will be effective for the upcoming 2024 Plan Year, which is January 1, 2024 - December 31, 2024.

- H&W Trust Open Enrollment is NOT mandatory.

- If you are currently enrolled in benefits and want to keep your current benefit elections for 2024, you do NOT need to complete H&W Trust Open Enrollment...it will automatically continue in 2024.

- EXCEPTION: If you want to have the FSA (Health Care and/or Dependent Care) for 2024, you are REQUIRED to enroll in the FSA during H&W Trust Open Enrollment. Your 2023 FSA enrollment will NOT automatically continue in 2024.

- If you are currently enrolled in benefits and want to keep your current benefit elections for 2024, you do NOT need to complete H&W Trust Open Enrollment...it will automatically continue in 2024.

-

Enroll NOW in Benefits

Monday, October 9, 2023 - Friday, October 27, 2023

-

- PAT Active Members will be automatically enrolled in the mandatory Basic Life, Basic Accidental Death & Dismemberment (AD&D), and self-pay Long Term Disability (LTD) coverage, even if waiving medical plan coverage.

- Full-Time PFSP Active Members will be automatically enrolled in the mandatory self-pay Long Term Disability (LTD) coverage, even if waiving medical coverage.

- PAT Active Members will be automatically enrolled in the mandatory Basic Life, Basic Accidental Death & Dismemberment (AD&D), and self-pay Long Term Disability (LTD) coverage, even if waiving medical plan coverage.

-

IMPORTANT: We encourage you to access PeopleSoft Employee Self-Service (ESS) while on-site to complete your online benefits enrollment or make any personal information changes. If you would like to access PeopleSoft ESS off-site (e.g., from home), you MUST be set up with both 1) Duo 2-Step Security and 2) Google Authenticator Two Step Authentication. For assistance, contact the PPS IT Service Desk at 503-916-3375. For more information: https://www.pps.net/selfservice.

What Has Changed for the 2024 Plan Year?

-

The Health & Welfare Trust will send you an Open Enrollment packet for the 2024 Plan Year. Inside your Open Enrollment packet, you will find out what is new for the 2024 Plan Year, a Benefit Guide that explains your options and provides enrollment instructions, and much more.

If you have not received your Open Enrollment packet by October 9, 2023, please contact:

Health & Welfare Trust - Administrative Office

(managed by Zenith American)Phone: 833-255-4123 (toll free) or 503-486-2107 (local)

Email: SD1@zenith-american.com

Health Insurance Package Options, Costs, & More for ATU, DCU, PAT, & PFSP

-

View Health Insurance Package Options, Costs, & More for the 2023 Plan Year on the

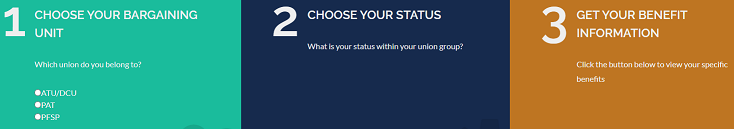

H&W Trust Open Enrollment Website:- Select your Bargaining Unit (i.e., your Employee Group);

- Select your Status; then

- Click the GO! button.

Additional Benefits Information - ATU, DCU, PAT, & PFSP

-

Am I Eligible for Benefits?

ATU Employees

- Full-Time ATU Employees: To qualify for the full-time employee health insurance package, you must be regularly scheduled to work at least 30 hours per week (0.75 FTE).

- Part-Time ATU Employees: Part-time employees (less than 30 hours per week (0.74 FTE and below) are not eligible for the health insurance package, unless they are Type 10 Drivers.

ATU Type 10 Drivers

- Eligible ATU Type 10 Drivers work an average of 20 hours or more per week over the course of a semester to qualify for benefits eligibility the following semester. There are two 6 month eligibility periods per year: fall (Oct 1st - March 31st) and spring (April 1st - Sept 30th).

DCU Employees

- Full-Time DCU Employees: To qualify for the full-time employee health insurance package, you must be regularly scheduled to work at least 30 hours per week (0.75 FTE).

- Part-Time DCU Employees: Part-time employee (less than 30 hours per week (0.74 FTE and below) are not eligible for the health insurance package.

PAT Employees

- Full-Time PAT Employees: To qualify for the full-time employee health insurance package, you must be regularly scheduled to work at least 30 hours per week (0.75 FTE).

- Part-Time PAT Employees: To qualify for the part-time employee health insurance package, you must be regularly scheduled to work at least 20 hours per week (0.50 FTE), but less than 30 hours per week (0.74 FTE).

PFSP Employees

- Full-Time PFSP Employees: To qualify for the full-time employee health insurance package, you must be regularly scheduled to work at least 30 hours per week (0.75 FTE).

- Part-Time PFSP Employees: To qualify for the part-time employee health insurance package, you must be regularly scheduled to work at least 20 hours per week (0.50 FTE), but less than 30 hours per week (0.74 FTE).

Questions about benefits eligibility?

PPS Benefits Team

Email: benefits@pps.net - Full-Time ATU Employees: To qualify for the full-time employee health insurance package, you must be regularly scheduled to work at least 30 hours per week (0.75 FTE).

-

Eligible Dependents & Secova Dependent Eligibility Verification

- Eligible Dependents (H&W Website)

- Secova Dependent Eligibility Verification (H&W Website)

- Eligible Dependents (H&W Website)

-

Covering a Domestic Partner/Domestic Partner's Child(ren)?

If you are covering a Domestic Partner*/Domestic Partner's Child(ren) on your PPS benefits:

- Review the 2024 Domestic Partner Imputed Income Rate Sheet for your specific Employee Group on the H&W Open Enrollment Trust Website for information about the increase in taxes (imputed income tax) associated with covering a Domestic Partner/Domestic Partner's Child(ren).

- Complete the Affidavit of Domestic Partnership form and have the form notarized by an Oregon Notary.

- Most banks offer free notary services and only one of the two partners needs to be present.

- Free notaries will be available during the Benefits Fair and Open Enrollment Lab: https://www.pps.net/Page/20007.

- PPS does have free notaries available in Human Resources at the Dr. Matthew Prophet Center (formerly BESC) by appointment only. Email benefits@pps.net to schedule an appointment.

- Submit your completed notarized Affidavit of Domestic Partnership form to the PPS Benefits Team at benefits@pps.net by Thursday, November 30, 2023.

If you do NOT complete/submit your notarized Affidavit of Domestic Partnership form by the deadline listed above, your Domestic Partner/Domestic Partner's Child(ren) will be dropped from your benefits.

IMPORTANT: The value of your domestic partner health insurance coverage is considered a taxable benefit under federal IRS regulations. If you have domestic partner health insurance coverage, an additional taxable income, also known as imputed income, is added to your pay each month and then the appropriate taxes are withheld. The impact on your tax withholding will depend on your gross pay and your W-4 filing status. PPS cannot provide tax advice. We strongly encourage you to seek out a certified tax professional for assistance.

* A Domestic Partner is an unmarried individual of the same or opposite sex whom you have been living with for six months or more prior to enrolling in PPS benefits. NOTE: A legally married spouse is not a Domestic Partner. - Review the 2024 Domestic Partner Imputed Income Rate Sheet for your specific Employee Group on the H&W Open Enrollment Trust Website for information about the increase in taxes (imputed income tax) associated with covering a Domestic Partner/Domestic Partner's Child(ren).

-

Flexible Spending Account (FSA) - Health Care FSA & Dependent Care FSA

IMPORTANT: If you had the FSA (Health Care or Dependent Care) last plan year, you MUST re-enroll during the Health & Welfare Trust Open Enrollment to continue participating in the FSA for the upcoming 2024 Plan Year.Enroll in the Flexible Spending Account (FSA) for 2024 Plan Year

- Complete/submit your FSA enrollment in PeopleSoft Employee Self-Service (ESS) by Friday, October 27, 2023, the last day of H&W Trust Annual Open Enrollment.

If you do NOT complete/submit your FSA enrollment in PeopleSoft ESS by the deadline listed above, 1) you will NOT have the FSA for the 2024 Plan Year AND 2) you will NOT be eligible to enroll in the FSA again until next year's H&W Trust Open Enrollment or within 31-calendar days of a qualifying event, such as loss of coverage.

What is the FSA?

The Flexible Spending Account (FSA) is a way for you to save income taxes when paying for eligible Health Care OR Dependent Care expenses. Normally, the FSA is a use it or lose it plan and any unused funds are forfeited.

- Health Care FSA

Related expenses may include medical, prescription, vision and dental insurance co-pays, coinsurance, and deductibles not covered by insurance. The 2023 Health Care FSA contribution limits are a minimum of $240 up to a maximum of $3,050 per plan year. The first time you enroll in a Health Care FSA, you will receive a FSA debit card, which allows you to pay directly from your FSA account without having to wait to be reimbursed. Review the IRS Rules regarding undocumented FSA debit charges. - Dependent Care FSA

May be used for a qualifying dependent under the age of 13 or an eligible dependent who is physically or mentally incapable of self-care. The 2024 Dependent Care FSA contribution limits are a minimum of $240 up to a maximum of $5,000 per plan year. You can access account information online and set up recurring payments for reimbursement of dependent care expenses.

Additional FSA Information:

-

Federally Required Notices

Required Notices (H&W Trust website)

Questions?

-

Health & Welfare Trust - Administrative Office (Plan Administrator)

(managed by Zenith American)

Phone: 833-255-4123 (toll free) or 503-486-2107 (local)

Email: SD1@zenith-american.com

Website: https://sdtrust.com