-

ATU Type 10 Drivers Employee Group

Benefit Guide

Effective January 1, 2025 - December 31, 2025

-

Portland Public Schools (PPS) offers a comprehensive benefit package designed to provide employees and their families with a range of employer and employee paid benefit options.

It is the employee’s responsibility to enroll online in a timely manner to activate benefit elections of their choice and process his/her employment with PPS.

Additional PPS benefits information may be found on the Benefits website at: https://www.pps.net/Page/15959.

-

PeopleSoft Employee Self-Service (ESS)

The PeopleSoft Employee Self-Service (ESS) Portal (https://selfservice.pps.net) gives employees access to view and make changes to certain personal information:- Paychecks

- W-2

- Tax Withholding Allowances (W-4)

- Direct Deposit

- Home Addresses

- Phone Numbers

- Personal Email Addresses

- Emergency Contacts

- Benefit Elections

- Dependent Information

- Add Life Events

- 403(b) Changes

This is a secure site that will maintain data integrity while also allowing access to your vital information and is accessible from inside and outside of the PPS network.

PeopleSoft ESS Login Issues? Contact PPS IT Service Desk at 503-916-3375

Health Insurance - ATU Type 10 Driver

-

What is Included in My Health Insurance Package?

Eligible ATU Type 10 Drivers work an average of 20 hours or more per week over the course of a semester to qualify for benefits eligibility the following semester. There are two 6-month eligibility periods per year:

- Fall (October 1st - March 31st); AND

- Spring (April 1st - September 30th).

The health insurance package for ATU Type 10 Drivers includes:- Medical & Prescription

The School District No. 1 Health & Welfare Trust offers one (1) Kaiser Permanente Health Maintenance Organization (HMO) Plan, one (1) Providence Preferred Provider (PPO) Plan, and one (1) Providence In-Network Plan. These plans have no pre-existing condition waiting periods. All medical plans include prescription benefits.

- Vision

All ATU Type 10 Drivers enrolled in a Trust medical plan will have vision coverage. Employees who enroll in a Providence Medical Plan will have Vision Service Plan (VSP). Employees who enroll in Kaiser medical insurance will have Kaiser Vision.

- Dental

ATU Type 10 Drivers enrolled in a Trust medical plan will have dental coverage. Two dental plan options are offered: Trust Dental Plan (administered by Delta Dental of Oregon) and Kaiser Dental. Both dental plans are traditional fee-for-service plans.

-

What is the Cost of the Health Insurance Package?

Most District employees share in the cost of health insurance premiums. The payroll deductions for medical insurance are withheld from the employee’s pay on a pre-tax basis. Premiums are deducted the month prior to coverage (i.e., September paycheck pays for October coverage).

For monthly rates/costs, visit the Health & Welfare Trust Website: https://sdtrust.com/mybenefits_health.php.

-

Eligible Dependents & Secova Dependent Eligibility Verification

Eligible Dependents

- Your legal married spouse (including same sex married spouse);

- Eligible domestic partner, living together for six (6) months or more prior to enrolling in PPS benefits - Affidavit Required

- See Covering a Domestic Partner/Domestic Partner's Child(ren)? section below for more information

- Your children and your legal spouse’s or domestic partner’s children, up to age 26:

- This includes natural children, stepchildren, legally adopted children, children for whom you are the legal guardian, foster children, and children for whom you are legally responsible to provide health coverage under a Qualified Medical Child Support Order (QMCSO).

- Disabled children over age 26 if unmarried, incapable of self-support, dependent on you for primary support, and the disability occurred before the age of 26.

- For more information on covering disabled adult children, contact the Health & Welfare Trust (plan administrator) at 503-486-2107.

Eligible dependents do NOT include:

- A spouse from whom you are legally separated or divorced

- Anyone on active military duty

- Children over the age of 26 who are not disabled

- Your grandchildren, nieces/nephews or other relatives who live with you (unless you have court-appointed custody)

IMPORTANT: You must notify the Health & Welfare Trust Administrative Office when a dependent is no longer eligible. You may be required to repay the Trust for any benefits paid after the dependent’s eligibility ends.

You will be required to submit the required documentation for all your dependents enrolled in your PPS health insurance plan

The Affordable Care Act (ACA) requires the District to collect social security numbers for all dependents enrolled in the employee’s medical plan. The social security numbers are used as identifiers in reporting health insurance coverage to the IRS. Dependents for which social security numbers are not provided may not be enrolled.

Secova Dependent Eligibility VerificationTo ensure that all enrolled dependents meet the Health & Welfare Trust’s eligibility requirements, the H&W Trust works with Secova, an independent firm, to conduct confidential dependent eligibility verification.

If you are covering dependents, you must fully complete the mandatory dependent eligibility verification through Secova

- Within 45 days AFTER enrolling in benefits, you will receive your verification packet from Secova to the mailing address on file for you.

- You MUST submit directly to Secova all required documents for the dependents you are covering on your PPS health insurance by the deadline provided in your verification packet.

- IMPORTANT: If you do NOT fully complete the mandatory dependent verification audit through Secova, your dependents will be dropped from your PPS health insurance on the first of the month following receipt of a final termination letter from Secova.

More information on the Secova dependent eligibility verification can be found on the H&W Trust website at https://sdtrust.com/enroll_dependent_verification.php. - Your legal married spouse (including same sex married spouse);

-

Covering a Domestic Partner/Domestic Partner's Child(ren)?

For employees covering a Domestic Partner*/Domestic Partner’s Child(ren), the IRS requires the District to withhold federal and Social Security taxes on the fair market value of the domestic partner and their dependents’ coverage. This is in addition to the base premium that all employees pay based on the plan they choose. State taxes may also be withheld depending on the employee’s situation. The Imputed Income is also subject to the 6% PERS contribution for OPSRP Pension Members only (hired on or after August 29, 2003). Please contact the PPS Benefits Department for more details.

For more information on imputed income, please visit the Health & Welfare Trust website at https://sdtrust.com/.

IMPORTANT: The value of your domestic partner health insurance coverage is considered a taxable benefit under federal IRS regulations. If you have domestic partner health insurance coverage, an additional taxable income, also known as imputed income, is added to your pay each month and then the appropriate taxes are withheld. The impact on your tax withholding will depend on your gross pay and your W-4 filing status. PPS cannot provide tax advice. We strongly encourage you to seek out a certified tax professional for assistance.

If enrolling a Domestic Partner/Domestic Partner’s Child(ren), the domestic partnership must have been established for at least six (6) months preceding the effective date of coverage. A Certificate of Registered Domestic Partnership OR a notarized Affidavit of Domestic Partnership must be received by the Benefits Department within three (3) days of your enrollment. The affidavit can also be found on our Benefit Forms webpage at: https://www.pps.net/Page/18910.

- Most banks offer free notary services and only one of the two partners needs to be present.

- PPS does have free notaries available in Human Resources at the Dr. Matthew Prophet Education Center (formerly BESC) by appointment only. Email benefits@pps.net to schedule an appointment.

* A Domestic Partner is an unmarried individual of the same or opposite sex whom you have been living with for six months or more prior to enrolling in PPS benefits. NOTE: A legally married spouse is not a Domestic Partner. -

Benefits Enrollment & Changes

There are only three times when you can enroll in benefits or possibly make changes to your benefits:

- During the Fall (October 1st - March 31st) eligibility period.

- During the Spring (April 1st - September 30th) eligibility period.

- Within 31-calendar days* of a qualifying event.

* Unless otherwise indicated. - During the Fall (October 1st - March 31st) eligibility period.

-

How Do I Enroll in Benefits?

Twice per year, those ATU Type 10 Driver employees who qualified for the next semester's coverage will be mailed and emailed a letter and enrollment form. The enrollment form can either be mailed back to the PPS Benefits Team at the address listed at the bottom of the form or emailed to benefits@pps.net. Those ATU Type 10 Drivers enrolled in the previous semester's coverage do not need to submit a new enrollment form unless they want to make changes to their plan elections or drop coverage.

In preparation, we encourage you to do the following before enrolling in benefits:

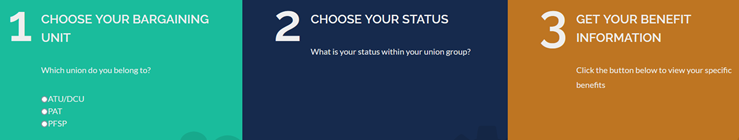

- View all the benefit information on the H&W Trust website

-

- Select your Bargaining Unit (i.e., your Employee Group);

- Select your Status; then

- Click the GO! Button

- If you will be covering dependents (spouse/domestic partner/children), gather their dates of birth and social security numbers.

- For your beneficiaries, gather their dates of birth and social security numbers.

-

How Do I Make Changes to My Benefits?

IRS rules state that benefit selections may only be changed when an employee experiences a qualifying event or during the Annual Open Enrollment period. The employee must complete an online enrollment via PeopleSoft Employee Self-Service (ESS) and upload the appropriate required documentation. The change must be consistent with the event.

Qualifying Events

Employees who experience a qualifying event must submit the required supporting documentation to the PPS Benefits Team and complete their benefits elections within 31-calendar days* from the date of the qualifying event.

* Unless otherwise indicated

For more information and instructions on making changes to your benefits due to a qualifying event visit:- Benefits Enrollment & Changes webpage: https://www.pps.net/Page/7324

- Examples of Qualifying Events & Required Documentation: https://www.pps.net/Page/18906

Open Enrollment PeriodFor eligible ATU Type 10 Drivers there are two 6-month eligibility periods per year: fall (Oct 1st–March 31st) and spring (April 1st–Sept 30th). Those ATU Type 10 Drivers that qualify for the next semester’s eligibility period will be mailed an enrollment packet in the mail a little over a month prior to the beginning of the new eligibility period. For example, packets for enrolling or making changes during the fall period will typically be mailed in early September, for coverage changes beginning October 1st.

-

Eligibility Timelines

Eligible ATU Type 10 Drivers must enroll in their choice of medical plan during the 31-calendar days prior to the start date for either Fall or Spring semester eligibility periods. See How Do I Enroll in Benefits? section above. ATU Type 10 Drivers that are eligible for the upcoming eligibility period will receive an email and letter to the mailing address PPS has on file with the enrollment form when the enrollment period is active.

IMPORTANT: If the benefits eligible employee does not make a benefit election during this time period, enrollment changes will not be allowed until the next eligibility period or if a qualifying event occurs.

-

Insurance ID Cards

Insurance identification (ID) cards are issued directly from the insurance carriers. Processing time usually takes 3-5 weeks after submitting your online benefits enrollment.

If you or a covered dependent need medical attention prior to receipt of your insurance ID cards, please call your medical insurance carrier directly (contact information can be found at the bottom of this webpage). If the carrier is not showing coverage, contact the Health & Welfare Trust (plan administrator) for assistance at 503-486-2107.

If you have the VSP Choice Plan for vision insurance. VSP does NOT issue insurance ID cards for vision insurance. Contact VSP directly for information on how to access your vision insurance benefit at 800-877-7195 or https://www.vsp.com/.

-

When Will My Health Insurance Begin?

Eligible ATU Type 10 Drivers will begin coverage either April 1st or October 1st, dependent upon qualification by averaging 20 or more hours per week over the previous semester, and be eligible for insurance coverage for a 6-month period from that date until the next qualification window occurs and eligibility is assessed again.

-

When Will My Health Insurance End?

Coverage will terminate at the end of the month the employee resigns or ceases to be paid, unless the employee worked, or was paid, more than half the contract days of the month. Coverage will terminate at the end of the following month in this case.

Voluntary Benefits - ATU Type 10 Driver

-

TriMet Transit Pass

State and Federal tax laws allow employees to pay for the cost of a monthly TriMet Transit Pass on a pre-tax basis, which reduces taxable earnings.

For more information, including how to enroll, visit our TriMet Transit Pass Program webpage: http://www.pps.net/Page/1657.

-

Credit Union Memberships

PPS employees and their immediate family members are eligible to join the following credit unions for banking services such as savings, checking, IRAs, Certificates of Deposit, loans, and a variety of other services.

- OnPoint Community Credit Union

Customer Service: 1-800-527-3932 - Consolidated Community Credit Union

Member Services: 503-232-8070.

- OnPoint Community Credit Union

Retirement Benefits - ATU Type 10 Driver

-

Oregon PERS - Participation required, if eligible

The Oregon Public Employees Retirement System (PERS) is the state retirement plan for employees who work at least 600 hours per year and is mandated by law. Employees hired on or after 08/29/2003 are PERS OPSRP members unless membership was previously established by PERS.

PERS OPSRP membership is established after completion of a six (6) month waiting period for employees who work at least 600 hours per year, and requires an employee contribution of 6% of gross salary on a pre-tax basis to the Individual Account Program (IAP). If you are an existing PERS member, your mandatory contributions begin immediately. This contribution is not subject to Federal and State taxes until it is withdrawn from the retirement system. Additionally, the District contributes an amount to the OPSRP Pension Program for each covered employee. Vesting usually occurs after five (5) years of working at least 600 hours per year. Members automatically vest at age 65, even if they have worked fewer than five years.

There are two parts to the PERS OPSRP retirement benefit:

- Part 1: OPSRP Pension Program

The OPSRP Pension Program is funded by your employer. PPS contributes an amount set by state statute, necessary to continue funding the pension program. To gain access to the pension program you have to be vested which usually occurs after five (5) years of working at least 600 hours per year. Members automatically vest at age 65, even if they have worked fewer than five years.

AND - Part 2: Individual Account Program (IAP)

The Individual Account Program (IAP) is the required 6% contributed by you. Your account is credited with earnings or losses annually based on investment returns. You are automatically vested in your IAP account when your account is established.

For more information, visit our Oregon Public Employees Retirement System (PERS) webpage: https://www.pps.net/Page/18903.

- Part 1: OPSRP Pension Program

-

403(b) Plan Tax Deferred Annuity - Participation voluntary (optional)

The 403(b) Plan is a voluntary (optional) supplemental retirement savings program offered under section 403(b) of the Internal Revenue Code and is called the Tax-Sheltered Annuity Plan ("TSA Plan").

The PPS 403(b) Plan is administered by PenServ. PPS offers the following types of 403(b) Plans for eligible employees to contribute to:

- Traditional (pre-tax) 403(b) Plan; and

- Roth (after-tax) 403(b) Plan, subject to vendor acceptance of such contributions.

All contributions to the PPS 403(b) Plan are made by the employee. The District does not contribute toward the 403(b) Plan and there is no Employer Match.

For more information, including how to enroll, visit our 403(b) Plan Tax Deferred Annuity webpage: https://www.pps.net/Page/18904. - Traditional (pre-tax) 403(b) Plan; and

Other Benefits - ATU Type 10 Driver

-

Employee Assistance Program (EAP)

The Employee Assistance Program (EAP) provides free services to help people privately resolve problems that may interfere with work, family, and life. Here are just a few of the services EAP offers:

- 24-hour Crisis Help

- Childcare Referral & Eldercare Referral

- Confidential Counseling

- 6 free sessions per situation, per year to all benefits eligible employees and anyone living in their household

- 6 free sessions per situation, per year to all benefits eligible employees and anyone living in their household

- Financial Services

- Identity Theft Services

- Legal & Mediation Services

- Wellness

- Will Preparation

For more information, visit our Employee Assistance Program webpage: https://www.pps.net/Page/1730.

- 24-hour Crisis Help

What Leave Plans Are Available to Me? - ATU Type 10 Driver

-

Sick Leave

Eligible employees working at least 20 hours per week (0.50 FTE) accrue sick leave at the rate equivalent to one (1) day for each month worked. Employees who complete one (1) full year of service are credited with the equivalent amount of leave annually, every July 1st. All unused sick leave is carried over year to year.

-

Funeral/Bereavement Leave

Employees may use one (1) day to attend the funeral of a relative or friend. In the case of an immediate family member, three (3) to five (5) consecutive days of bereavement leave at 100% pay, plus two (2) additional days at two-thirds pay (as stated in the union contract) are available.

-

Paid Personal Leave/Emergency Leave

All benefits eligible employees receive three (3) paid personal leave days, which may only be used for unavoidable personal business, or for attending to matters which cannot be scheduled outside the employee’s work hours. One week advance notice is required for the latter, except in the case of an emergency. Paid personal leave shall not be used for recreation, other employment, union or political activities, or to extend other leave categories, unless on an approved Federal Family Medical Leave (FMLA) or Oregon Family Leave Act (OFLA). Paid Personal Leave is reset back to three (3) days July 1st of each year and any unused balance is forfeited on June 30th of the following year. Unit members who commence employment after the end of the first semester shall be entitled to one (1) day of paid personal leave.

-

Family Illness Leave

All benefits eligible employees receive three (3) family illness days per year, which is to be used in the event of illness of an immediate family member. “Immediate Family” is defined in the ATU union contract as the employee’s spouse, domestic partner, children, parents, grandparents, grandchildren, mother-in-law, father-in-law, brothers and sisters of the employee, and also any person living in the home with the employee (use of this leave shall be for instances where care or attention by the employee is necessary). Family Illness Leave is reset back to three (3) days July 1st of each year and any remaining balance is forfeited on June 30th the following year, if unused.

-

Holidays

Seven (7) specific holidays are designated and are paid as part of the contract year.

-

In the event that any statement in this guide varies from any benefit contract in effect, the benefit contract shall prevail.

Health Insurance Contact & Plan Information

-

Portland Public Schools recognizes the diversity and worth of all individuals and groups and their roles in society. All individuals and groups shall be treated with fairness in all activities, programs and operations, without regard to age, color, creed, disability, marital status, national origin, race, religion, sex or sexual orientation. This standard applies to all Board policies and administrative directives. Board of Education Policy 1.80.020-P.

-

Health & Welfare Trust

Administrative Office

(managed by Zenith American)

Phone

833-255-4123 (toll free) or 503-486-2107

Email

SD1@zenith-american.com

Website

https://sdtrust.com/index.php

Secure Account:

https://edge.zenith-american.com/

Mailing/Office Address:

12205 SW Tualatin Rd., Suite 200

Tualatin, OR 97062